In the bustling streets of Tokyo and beyond, a quiet revolution in consumer habits is taking place. Japanese 100-yen shops, long celebrated for their affordability and surprising quality, are now becoming go-to destinations for savvy shoppers seeking near-identical alternatives to premium brands at a fraction of the cost. These stores have evolved far beyond simple discount retailers - they're now producing what industry insiders call "high-spec clones" of popular branded goods, with quality that often rivals their expensive counterparts.

The phenomenon isn't about cheap knockoffs. Rather, it's about meticulous attention to detail in recreating the functionality and aesthetic of high-end products while maintaining the signature 100-yen shop price point (about $0.70 USD). From kitchenware that mimics high-end European brands to storage solutions indistinguishable from famous Scandinavian designs, these stores have mastered the art of delivering premium experiences on a budget.

Daiso, Seria, and Can Do lead this charge in Japan's highly competitive 100-yen shop market. What sets them apart is their ability to reverse-engineer popular products, identify what makes them desirable, and recreate those qualities using cost-effective materials and streamlined manufacturing processes. The results are startling - items that perform nearly identically to products costing three to five times as much.

In the kitchenware section, for instance, one might find silicone baking mats that bear uncanny resemblance to a famous French brand. Side by side, the differences are minimal - perhaps a slightly thinner silicone layer or less elaborate packaging. Yet the Daiso version sells for 100 yen versus 3,000 yen for the original. Similar parallels exist across categories: cosmetic organizers that mirror Muji's minimalist aesthetic, gardening tools comparable to premium German brands, and stationery that could pass for high-end European imports.

The secret lies in Japan's manufacturing expertise. These stores work with factories that often produce name-brand goods during regular shifts, then use the same facilities and similar (though not identical) materials during off-hours to create their own versions. This allows for remarkable quality control at rock-bottom prices. Moreover, Japanese consumers' exacting standards mean that even budget items must meet rigorous quality benchmarks - a cultural factor that elevates the entire 100-yen shop proposition.

Beauty products represent one of the most surprising areas of quality parity. Japanese 100-yen shops now offer makeup brushes with synthetic fibers nearly as soft as high-end animal-hair brushes, facial cottons comparable to luxury brands, and nail care tools that beauty professionals admit are functionally identical to their expensive counterparts. The packaging might be simpler, but the performance gap has narrowed dramatically in recent years.

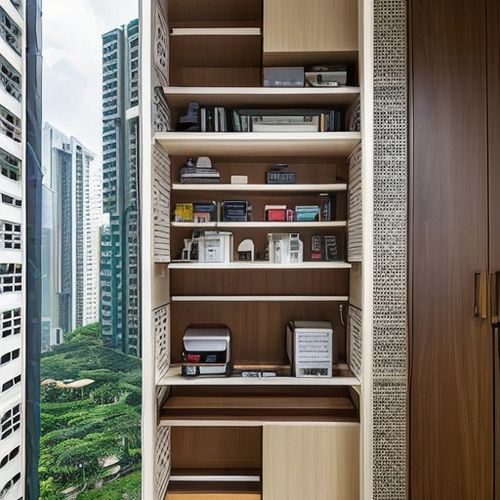

Home organization presents another category where the value proposition shines. The famous Japanese talent for space-saving innovation combines with this clone strategy to produce storage solutions that would cost 300-500% more if bearing a Western brand name. Stackable containers, closet organizers, and kitchen storage systems demonstrate particularly strong value, with designs clearly inspired by (but not exactly copying) premium European brands.

Interestingly, this trend isn't drawing significant legal challenges from brand owners. Japanese intellectual property law draws careful distinctions between inspiration and infringement, and the 100-yen shops navigate these boundaries skillfully. They modify designs just enough to avoid legal issues while preserving the core functionality that makes the original products desirable. The result is a win for consumers and a challenge to conventional pricing models in multiple industries.

For tourists visiting Japan, these stores have become mandatory shopping destinations. Word has spread through travel blogs and social media about the incredible value proposition. It's not uncommon to see visitors filling entire suitcases with 100-yen shop finds, from precision kitchen knives to innovative cleaning tools. The strength of this trend has even prompted some brands to reconsider their pricing strategies in the Japanese market.

As global consumers become more value-conscious without wanting to sacrifice quality, the Japanese 100-yen shop model offers intriguing possibilities. While other countries have dollar stores, none have achieved this level of quality parity with premium brands across such a wide range of categories. The success of these stores suggests a growing consumer willingness to prioritize function over brand prestige - a shift that could reshape retail landscapes worldwide.

The implications extend beyond individual consumer savings. If large segments of the market begin opting for these high-quality alternatives, it could force traditional brands to either justify their premium pricing more convincingly or face erosion of their market share. For now, though, smart shoppers are enjoying unprecedented access to quality goods at prices that seem almost too good to be true - except in Japan's 100-yen shops, where they're an everyday reality.

By Emily Johnson/Apr 14, 2025

By Amanda Phillips/Apr 14, 2025

By Jessica Lee/Apr 14, 2025

By John Smith/Apr 14, 2025

By Thomas Roberts/Apr 10, 2025

By Amanda Phillips/Apr 14, 2025

By Michael Brown/Apr 14, 2025

By Jessica Lee/Apr 14, 2025

By Elizabeth Taylor/Apr 14, 2025

By Elizabeth Taylor/Apr 10, 2025

By Sophia Lewis/Apr 14, 2025

By William Miller/Apr 14, 2025

By John Smith/Apr 14, 2025

By Emily Johnson/Apr 14, 2025

By Emma Thompson/Apr 14, 2025

By Sarah Davis/Apr 10, 2025

By David Anderson/Apr 14, 2025

By Emily Johnson/Apr 14, 2025

By Eric Ward/Apr 14, 2025

By Eric Ward/Apr 14, 2025